The days of simply opening the window to clear a stuffy house aren’t always available. For year-round relief and protection for your home start running a dehumidifier.

What do dehumidifiers do? Dehumidifiers reduce the amount of moisture in the air. They work just like air conditioners only they contain both hot and cold coils.

How do dehumidifiers work?

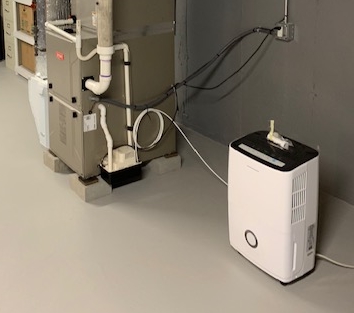

Air is drawn in to the dehumidifier and any moisture contained in that air is condensed onto cold coils. This dries the air. The dry air then passes over hot coils and is circulated back into the room. The moisture that condensed onto the cold coils is drained into a tank or “pint”. You have to periodically empty this tank to avoid overflow. Some dehumidifiers can simply be set to a certain humidity percentage and it will automatically run itself to maintain that specified level. If you don’t feel like emptying the you may find one with a pump system that you can then direct so that the water safely away from your foundation.

In the months that you run air conditioners in your home you may not need to run the dehumidifier if the air conditioning is keeping the humidity low enough. A hygrometer, which can be purchased at some hardware stores, will give you an accurate humidity reading.

Who can benefit from a dehumidifier?

Everyone can benefit from controlled air conditions, but even more so are people with allergies, asthma, or those who are living in moist conditions. Here on Cape Cod, being so close to the ocean, we are all very familiar with moist conditions.

Do you find that symptoms including stuffy nose, eye irritation or sneezing increase when spending time indoors? A number of irritants, including dust mites, could be the culprit. Dust mites live in mattresses, upholstery, curtains, rugs and even get mixed up the air. (This is why you should vacuum mattresses and upholstery once a week with a HEPA filter vacuum). Bringing the level of moisture in the air down will make it less environmentally friendly for mites, mold and mildew.

Controlling the indoor air humidity with a dehumidifier will also reduce the amount of dusting you need to keep up with, reduce door frame swelling, and lengthen the life of your windows by reducing any condensation on them. The air will smell noticeably fresher. You may even find that your laundry takes less time to dry, and that your food keeps longer.

What are signs of moisture?

- Stains on ceilings and/or walls

- A “stuffy” feeling when you enter a room

- Rotten trim and/or wooden areas

- Musty odors

- Condensation found on windows

- A hygrometer reading above 40-50%

How do you choose a dehumidifier? Your choices will be narrowed down with two variables: the amount of area the unit will cover and the size of the water tank that holds the condensed moisture. If you’ve ever purchased an air conditioner you know that it needs to be able to cover the entire cubic space of the room to work properly. Measure the area of space you’ll need to dehumidify (cubic feet) and select a unit that will cover at least that amount of space if not more. The higher the humidity in your geographical area, the larger the tank you’ll want your unit to have.

Don’t forget about maintenance on your dehumidifier. They can run above and beyond a few hundred dollars depending on the size you need so you’ll want to maintain them properly to get your money’s worth. Filters will need to either be cleaned or replaced so factor them into the cost when comparing units. Also, look for the energy efficient models to reduce the increase in electricity use. Some are also louder than others. If it’s in the basement you may not be too concerned with the noise, but if it’s close to a bedroom or entertaining space you may opt for a quieter version.

With all of the calls concerning mold in basements, musty bedroom and closet odors, and heat of summer mildew I highly advise that dehumidifiers are run to keep these occurrences at a minimum. If you do run into any of these while running a dehumidifier or not, always check first to make sure its not a slow leak, drip, or pending water damage. If it is, the sooner you find it the better.

Please feel free to contact me if you have any questions.